atc income tax india

Section 80C Section 80C of the Income Tax Act of India is a clause. Stay logged in.

What Is The Difference In The Career Growth Between Aai Atc And Aai Airport Operations Quora

15 lakh per financial year under Section 80C of the Income Tax Act and its allied sections such as 80CCC.

. This income tax exemption is allowed to HUF members as well as non-HUF members. Link for filling Online Departmental Examination 2022 Application Form for ITIITO - reg. Guidelines for Compounding of Offences under the Income-Tax Act 1961.

Employee Contribution Under Section 80CCD 1. Get Refund Advance up to 500 1 No Credit Check. 42 out of 5 stars.

To stay updated. We specialize in individual and small business tax preparation. A All corporate assesses.

Tax deductions under Section 80CCD are categorised in three subsections. Income Tax India. What is the phone number of ATC Income Tax Office.

You can try to find more information on their website. 10-IJ and Form No10-IL are available for filing on the portal. 189 rows The ATC column is only populated if there are any taxes withheld from your vendor.

Ask 1800 180 1961 1961. KUMAR CO Puttur Andhra. Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income TaxIt allows for a maximum deduction of up to.

A maximum of upto 10 of salary for. Qualified Widow er With Dependent Child. See the complete list of Alphanumeric Tax Codes that are available in JuanTax below.

Employee Contribution Under Section 80CCD 1. 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax. Common Tax Docs to Uploadupload only applicable items Your current W2 s 1099 s Sch-K1 andor all other income statements.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards. Income-tax Return Forms for Assessment Year 2022-23. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are. Atc Income Tax India. Bank of India has been migrated from OLTAS e-Payment of Taxes at NSDL to e-Pay Tax facility at the e-Filing portal for.

Itemized deductions allow you to deduct your expenses such as mortgage interest donations medical expenses and so. Social Security Card for you and any dependents call us if. Copyright 2021-2022 ATC Financial LLC.

What Is The In Hand Salary Of A Newly Recruited Aai Je Airport Operations Quora

Air Traffic Controller Jobs Colleges Eligibility Courses And Salary

Checklist For Indian It Professionals Filing Individual Income Tax Returns Aotax Com

Organization Structure Airports Authority Of India

Changing Dynamics Of Income Tax Scrutiny Assessment The Financial Express

Atc Completes Rs 3 800 Cr Mobile Tower Deal With Vodafone India Idea Pact Expected By May Zee Business

Atc India Income Tax Preparer Tax Consultant Linkedin

Is Atc Air Traffic Controller Exam Conducted By Aai Really Tough For A B Tech Guy What Is The Syllabus Quora

Noida International Airport Runway Atc Tower Construction In Full Swing First Phase To Be Completed By 2024

Income Tax Slab Budget 2022 Income Tax Slabs For Fy 2022 23 In India The Economic Times

Empanelment 124 Irs It Officers Promoted As Commissioner Of Income Tax

With Model Code Of Conduct In Place I T Officials To Track Cash Movement At Airports The Statesman

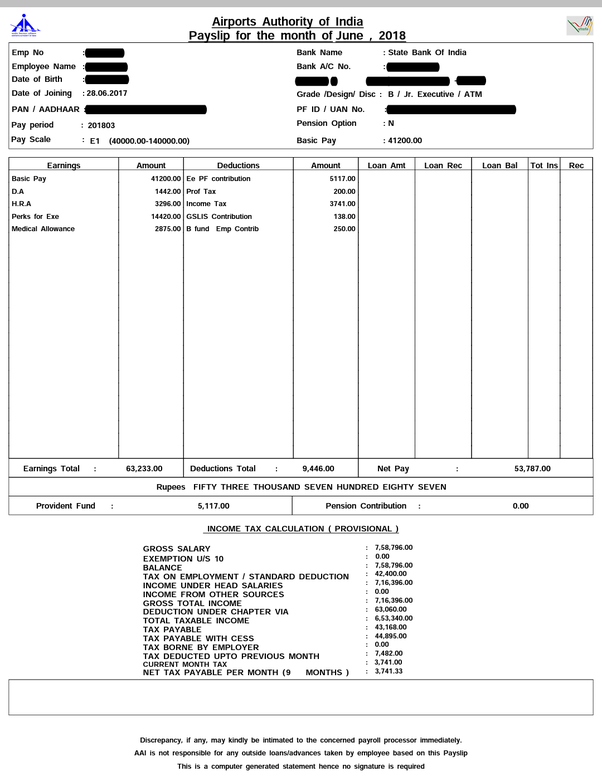

Aai Junior Executive Atc Salary In Hand Salary Job Profile Promotion

Oecd S Crypto Asset Reporting Framework Could Be Pivotal For Tax International Tax Review

Refund Advance E File Complete Tax Service Atc Income Tax

How To Make Atc Certificate What Is Atc Certificate In Gem Atc Certificate In Gem Portal Youtube

Tiol Tax News Gst Income Tax Service Tax Customs Central Excise International Taxation Fiscal Policy Monetary Policy Economy Revenue Judicial Decisions Tax Rulings Tax Video